As we are about to enter an uncertain 2023 in the face of economic volatility, inflation and shifting consumer habits, the consumer and retail industry faces tremendous pressure to drive growth. Let's take a closer look at market conditions.

Profit margins are thinning due to high inflation

Global retail sales are forecasted to rise with 5% in 2023, but with global inflation most likely over the 6% mark and demand flattening, retailers’ profits will be in for a squeeze. Higher costs for labour, energy, raw materials and logistics will most certainly affect their margins and will limit sales growth. Adverse conditions could even see some retailers having to close shop, as the prolonged crisis means the risk of bankruptcies will increase.

One way retailers will try to protect their bottom lines in 2023 is by slashing labour costs. Many countries, particularly in Europe, have seen retail wages rise faster than overall private-sector wages. Although that probably won’t mean massive layoffs, increased pressures on retailers’ margins will slow down new hires.

Many retail chains will also invest in automating their backend processes, reducing their need for workers. By March 2023 Australian department chain Myer will deploy 200 autonomous mobile robots with the capacity to process seven out of ten online orders. Japan’s Aeon will collaborate with British retailer Ocado to build an automated warehouse in Japan by 2023 to manage stocks and basket goods for online deliveries.

Online retail growth is likely to shift to developing markets

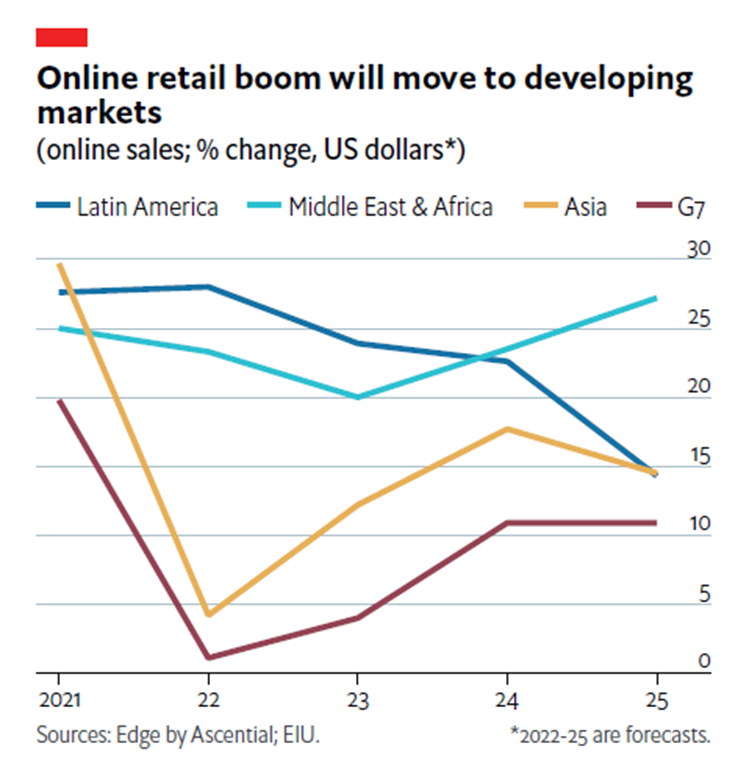

Online sales will continue to rise, with projected year-on-year growth of over 6% taking their share of global retail sales to more than 14%, marginally exceeding the 13.9% share in 2022. However, sales growth will slow in China, the world’s largest online retail market, as a result of its Covid-related policies as well as high youth unemployment, a weakening economy and a government crackdown on technology companies. Meanwhile, the Western hemishpere will have to go through the cost-of-living crisis and a recession.

A growing middle class, increasing internet penetration and policy focus on digitalisation will make many emerging markets attractive for retail investment. The Middle East, Africa and Latin America will see the fastest pace of growth in online sales in 2023, at over 20%, while Asia is likely to report a 12% increase. Amazon plans to enter five new countries in 2023, with South Africa, Nigeria and Colombia among the candidates. There will also be opportunities for marketplaces, logistics and payment service providers in all these areas of the Globe to support online retail growth.

Customer engagement continues to be key

In retail, customer engagement is the subject of constant innovation, striving to always go where no one has gone before. Digital presence is continuously proliferating to get up close and personal with customers, while physical stores are not giving up: they are smartening up to match online experiences in ways never imagined. Amazon is one of the best examples, with its physical bookstores or its entirely automated grocery stores, and with its plans to open large-scale retail stores. Retail engagement continues to move from online experiences to creating omnichannel experiences.

While traditional retailers are dabbling into self-checkout kiosks, click-and-collect points, augmented-reality dressing rooms, mobile checkouts and are trying hard to build an online presence—online-only retailers are exploring physical selling. It makes technological infrastructure and technology integration and transformation doubly challenging, and a key element in delivering customers what they want.

Omnichannel shopping will dominate FMCG sales

According to Nielsen IQ, 86% of shoppers purchase goods both in physical stores and online, while 14% shop exclusively in physical stores. Less than 1% of consumers shop exclusively online. Far from being a passing trend,

omnichannel is a permanent – and substantial – fixture of consumer behavior. Globally, 30% of consumers indicated that they now have a completely different set of priorities that impact their purchase behavior, and 59% are re-evaluating their priorities.

Cashless, contactless and autonomous purchasing and delivery

This trend revolves around the convergence of hybrid and omnichannel innovations but focuses on the all-important “last mile” of the retail experience. Consumers are demanding more streamlining and efficiency in the way they pay for goods and services and how they make their way into customers’ hands.

Convenience trends such as buy-online-pickup-in-store (

BOPIS), buy-online-return-in-store (

BORIS), and buy-online-pickup-at-curbside (

BOPAC) are quickly becoming expected as standard. Artificial intelligence and advanced analytics make these a possibility by automating the complex inventory management processes required. It’s also essential for the new methods of autonomous delivery that retailers are increasingly trialing, piloting, and rolling out in real-world deployments.

Social commerce is here to stay

Social commerce is forecasted to reach 20% of global retail e-commerce sales, which is big. Three quarters of online retailers already sell on social media, with social storefronts and shoppable posts. Furthermore, influencer marketing has become a strategic targeting of the right online audiences, and positive advertising through rapid returns. The effectiveness of user generated videos has been measured to be 22% higher than that of brand videos, and this is why even big brands like Starbucks, Adidas or Dunkin’ Donuts use it extensively to market to online audiences.

Wrapping up

While 2023 will bring its own share of highs and lows, the retail industry will continue to evolve. And shopper behavior will follow suit. Boundaries between physical and digital will keep blurring. Smartphones will stay the shopper’s best friend and go-to assistant for more and more purchases. Among it all, brands and retailers that are equipped to capture and harness their customer and

product data, and navigate trends across segments, will be best positioned to win.